Market forecast:

STI having immediate support @ 3260 level and below this level it can take support @3240-3220 will be the support zone for STI.

STI having immediate support @ 3260 level and below this level it can take support @3240-3220 will be the support zone for STI.

Today STI again test the new high @ 3290.90, but closed below the opening level, as it is trading at higher level so it’s may be a take a break move.

STI trading in an uptrend and having next Resistance level @ 3315 mark, and if it will sustain above this then we can see it to all time high levels soon.

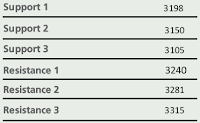

STI having support @ its previous resistance level i.e. 3240 mark and if STI crossed this level then we can see lower levels and 3220-3195 will act as a major support zone for STI.

Support:

STI having immediate support @ 3260 level and below this level it can take support @3240-3220 will be the support zone for STI.

STI having immediate support @ 3260 level and below this level it can take support @3240-3220 will be the support zone for STI.

Resistance:

STI having immediate Resistance @3300 and above this level it may take resistance @ 3315-3350 levels.

Technical indicators:

Technical indicators are seems to overbought zone on charts.

8:37 PM

8:37 PM

Admin

Admin